The General Department of Taxation has announced the Notification on the Implementation of Improper Tax Declaration Notification Letter.

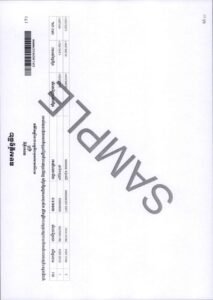

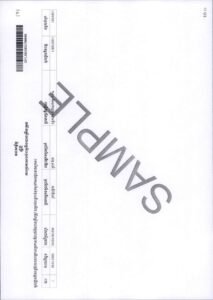

The General Department of Taxation of the Ministry of Economy and Finance would like to inform the administrator or enterprise owners, taxpayer and tax agents that in events of any irregularities in the declaration and payment of taxes , the General Department of Taxation will notify your enterprise of the incorrect declaration (Annex 1) and will provide a detailed list of the transactions (Annex 2) . The notice will be sent directly to your enterprise location or electronically.

In case of agreement with the notice, you must pay the taxes and surcharges within 30 working days after receiving the notice. Payments can be made at a commercial bank that has signed an MOU with MEF or through the e-Payment System using the barcode or QR code provided. The system will automatically update your tax declaration after payment.

In case of disagreement with the notice, you have 30 working days to respond in writing with your objections and supporting documents and you can submit your response at the tax administration counter or through the GDT e-Administration.

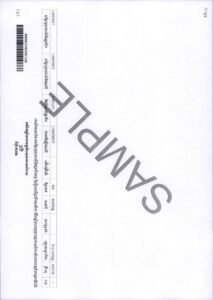

The failure to respond within 30 working days will lead to the issuance of a second notice (Annex 3). If no action is taken or the tax remains unpaid, the tax will be considered a debt and subject to tax audits and enforcement actions in accordance with the law in force.

The General Department of Taxation urges compliance with this notice and the effective implementation of its contents from the date of signing.

Click here: https://t.me/c/1377322939/1134